Why Customer Data is Essential for Effective Marketing – Especially to Your Customers

I’ve long been a practitioner of data-driven marketing, where you use the insights gleaned from analyzing your customer data to develop future marketing initiatives.

One of the most powerful applications of data-driven marketing is targeting specific individuals with direct mail and e-mail campaigns based on their previous relationship with you or their similarity to your best customers.

Marketers who do it right are able to:

- Craft messages with extremely high relevance, which boosts the open rate and strengthens the company’s relationships with its customers;

- Up-sell and cross-sell additional products and services;

- Generate a higher return on their marketing investment by targeting their marketing campaigns to individuals with the highest propensity to respond.

But there’s another crucial reason to make data-driven marketing part of your marketing strategy. If you DON’T use the data you have when you’re selling to a current or past customer, you risk your entire customer relationship by looking like you don’t know who your customers are.

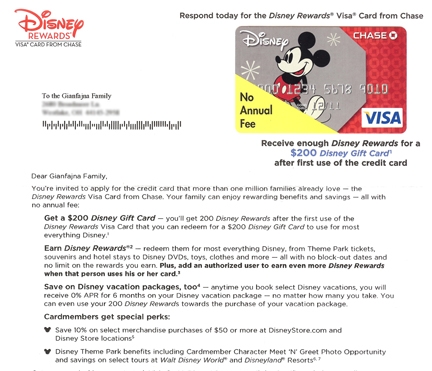

Case in point: The Disney VISA card from Chase.

I once had a deep relationship with Disney. When my children were in elementary school, we watched the Disney Channel, shopped at the Disney Store, bought Disney Princess Halloween costumes, visited DisneyWorld, and even took the Disney Cruise.

When Disney launched its co-branded VISA card with Bank One (now Chase), we became Charter Cardmembers. Our credit cards showed “Day 1” as the start date for our cardmember relationship. We earned points on every purchase and used those points to buy more Disney products. We proudly wore our “Charter Cardmember” pins on our hats as we enjoyed Epcot and the Magic Kingdom.

When Disney launched its co-branded VISA card with Bank One (now Chase), we became Charter Cardmembers. Our credit cards showed “Day 1” as the start date for our cardmember relationship. We earned points on every purchase and used those points to buy more Disney products. We proudly wore our “Charter Cardmember” pins on our hats as we enjoyed Epcot and the Magic Kingdom.

Then the kids grew up, and we moved on to other types of entertainment. Eventually we closed our Disney VISA accounts.

Since then, Chase and Disney have sent us frequent mailings inviting us to become cardmembers again. But their most recent direct mail package is a classic example of the poor use of data in communicating with lapsed customers.

Here’s the letter and here’s what’s wrong with it:

- There’s no reference anywhere to our prior relationship with Disney and Chase. Remember, we were Charter Cardmembers from Day 1; we were among their earliest adopters and we redeemed points from our card at multiple Disney venues. They must have this data, but they didn’t use it.

- There’s no appeal to a family whose children are now in their late teens or early twenties. They know this, too, because they surely have this data on our family as well as nearly every household in America.

- They didn’t even get our name right. Gianfagna isn’t the easiest name to spell, but if they’d run their mail file against their own customer file, or through any data cleanup process that uses commercially available U.S. household information for address correction, they’d have learned pretty quickly that there’s no “j” in “Gianfagna.”

So what could Chase and Disney have done instead? Here’s my unsolicited advice:

Dig deeper into the customer file and find all the Charter Cardmembers who are lapsed customers. Append those records with current demographic data to see how many are families with grown children or adults who are now grandparents. Send these empty-nesters a direct mail package promoting the fun and value of the Disney experience for adults, or a package targeting grandparents with grandkids for that segment of the mailing list. Most important, acknowledge and celebrate the customer’s prior relationship with Disney and demonstrate — in a way that’s relevant and real — why restarting that relationship now, at a new point in the customer’s lifecycle, is an unbeatable offer.

That’s a direct mail package I’d read, and maybe even say yes to.

Pingback:Welcome Smart Marketing Strategy » makeorbreakmoments.com